‘When taxation policy supports those in need, we applaud it. When it penalises those who have been hard-working, prudent and supported the wider economy, maybe we should ask questions,’ says Sharmila Meadows, as she looks at the proposed removal of the single person discount on council tax.

As the nation sizes up a new government, a chief theme has proved taxation. A hot topic during the general election campaign, as the Conservatives maintained that Labour would, if elected, raise taxes, raid pensions and pile pressure on household finances. It was an accusation that Keir Starmer continued to refute but one which, through his choices in power, remains highly febrile.From VAT on private schools to the cancellation of universal winter fuel payments for pensioners to murmurings about a £20 billion black hole in the public purse, the new Prime Minister and Chancellor are talking taxes. The taxes they assured us were safe from hikes.

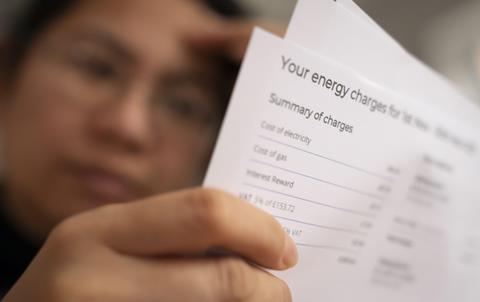

Now speculation looms about the removal of the single person discount on council tax.

Now speculation looms about the removal of the single person discount on council tax. As yet, there is no announcement or expressed policy intention to this effect, but rumours have emerged after Communities Minister Angela Rayner refused to rule out any such change and fears grow about the next Budget. If in time, the government proceeds to remove this discount, the impact will be felt by more than eight million people.

Council tax was introduced in 1993 by John Major’s Conservative government, replacing the community charge and previous rates. It is levied on domestic property and composed of bands of fees, determined by the value of your property, as a form of means testing. The single person discount takes 25% off the annual bill for households constituting one person. It acknowledges that, for a tax levied on dwellings in order to fund local services, single person households place less demand upon their local councils than bigger households. It’s about fairness.

If the discount were removed, approximately 8.39 million dwellings in England could see their bills rise,

If the discount were removed, approximately 8.39 million dwellings in England could see their bills rise, based on figures from the Department for Levelling Up, Housing and Communities on the number receiving the discount in 2023. This equates to just over a third (34%) of all households. Single person households face high pressure from rent and mortgage payments because their costs aren’t shared. They include many pensioner households for whom the removal of the discount would compound the blow of their cancelled winter fuel payments.

Taxation policy cuts to the core of our concepts of fairness. To our perceptions of individual contribution and reward and the distribution of finance for the collective good. Questions that articulate around the differences between our main parties. Traditionally, the Labour Party is a party of the larger state that funds services and financially supports its population, whether through nationalisation or welfare. The Conservative Party focuses on the smaller state, free market, individual freedoms and creating the conditions in which citizens can reap the rewards of hard work. These differences manifest in policy approaches such as benefits, inheritance tax, business and private schooling. How we as voters feel about them shapes our political views precisely because taxation draws correlations between work, reward and what we deem fair.

Christians rightly grasp God’s heart for the poor and through history, have been at the forefront of campaigning and supporting those in need - through free Sunday schooling, prison reform, the abolition of slavery, overseas aid, soup kitchens and more. Yet the Bible is also a proponent of hard work and recompense for quiet endeavour (Proverbs 12 and Psalm 90:17). Paul himself speaks of not placing burdens on churches where he ministered, but working with his own hands to meet his needs (1 Thessalonians 4:11). When David Cameron came to power in 2010 and set about reforming the welfare system, he did so to incentivise work and make work pay more than benefits.

Read more on politics

‘Labour’s new VAT policy is a threat to our Christian schools’

Sir Keir Starmer has invited us to join his ‘Government of Service’

When taxation policy supports those in need, we applaud it. When it penalises those who have been hard-working, prudent and supported the wider economy, maybe we should ask questions. For as much as Scripture calls us to care for the poor, it also honours work and the diligent stewardship of resources (Matthew 25). While governments may deal in hard choices, they also deal in political will and we would do well to test their motives through that filter, remembering that we serve a God of infinite compassion, who is also a God of justice (Isaiah 30:18).

No comments yet